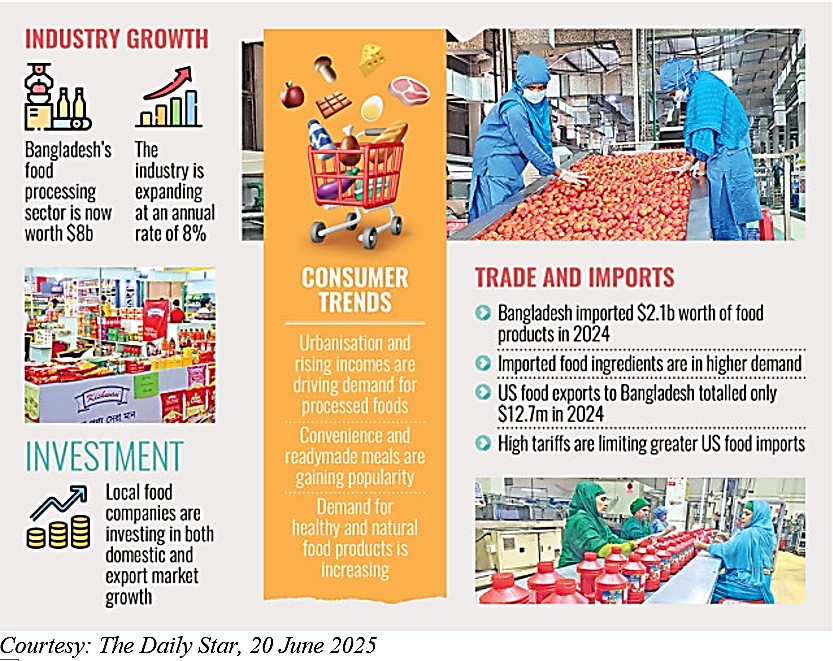

Since its independence, Bangladesh has gone through an industrial transformation. From a war-torn nation to becoming one of South Asia’s fastest growing economies, the journey contained leading industries such as Ready-Made Garments, Pharmaceuticals, Ceramics, Food Processing and many more. Bangladesh currently holds a $460 billion growing economy. This economy is the result of years of industrialisation, manufacturing excellence and market adaptation. Food and Beverage is another prominent industry of Bangladesh that has played a critical role in shaping our current economy.

Evolution and growth of Bangladesh’s beverage industry

For a long time, Bangladesh’s beverage industry was comparatively small and dominated by multinational giants. Consumer demand is centred around Coca‑Cola, Pepsi, 7UP, Sprite, and Fanta. Despite the presence of local brands, they were limited to juices while other categories remained underexplored.

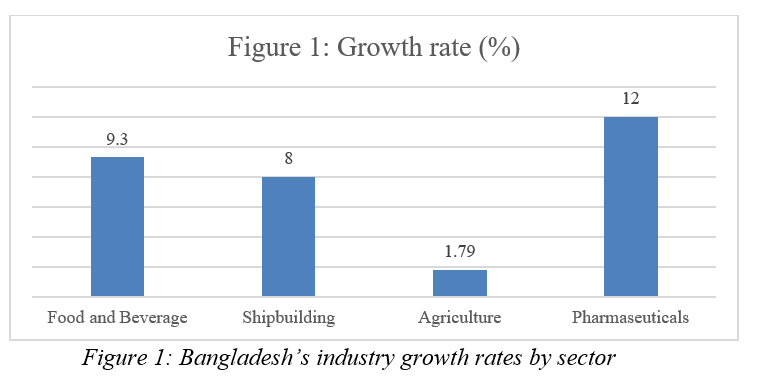

In contrast to the past, today, food and beverage has become one of the fastest‑growing sectors in Bangladesh, with an average yearly growth of around 7–8% in the 2000s. Now, it plays an important role in Bangladesh’s economy. According to Project Profile Bangladesh (2010), it makes up about 2% of the country’s GDP and provides jobs for a large number of people. Almost one out of every five industrial workers is working in this industry. Local companies such as Akij Food & Beverage Ltd. (AFBL) and Pran-RFL dominate in cola, juice, and energy drinks, while multinationals no longer hold majority share.

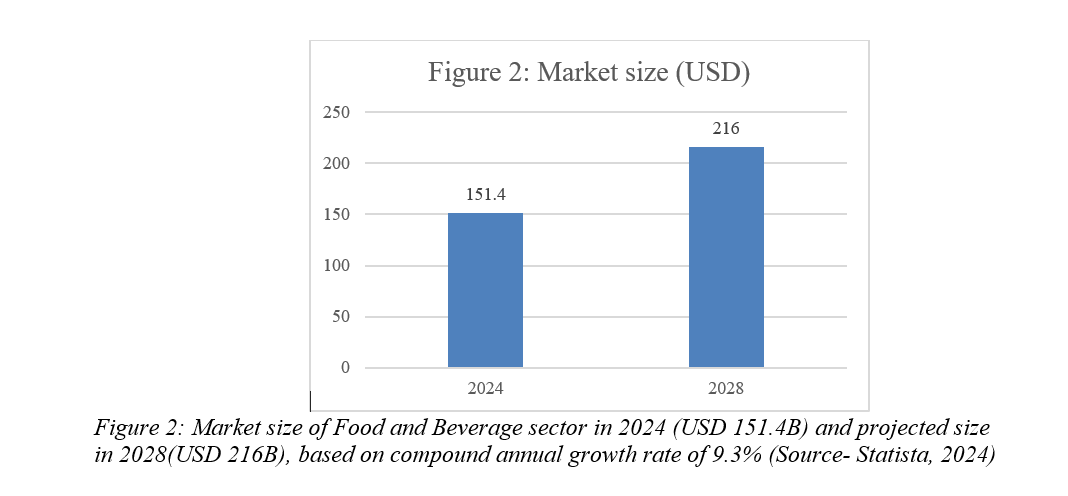

From an estimated Tk 4,000–6,000 crore market in the early 2000s to a Tk 151.4 billion market along with 3.38 billion litres consumed in 2024, Bangladesh’s beverage industry has evolved rapidly. Moreover, Bangladesh exported approximately $1.16 billion worth of agro‑processed food products in FY 2022–23, according to data from the Bangladesh Agro‑Processors Association (BAPA). This export growth is driven by diaspora demand and concentrated in diaspora-dense markets such as the UAE, Saudi Arabia, the US, the UK and more. Overall, the sector is not only contributing to its own country but also leaving its footprint beyond the borders

First steps of the industry in early Bangladesh and its challenges

Due to its vast population, Bangladesh has been an attractive market for global and local businesses for a long time. After the Liberation War of 1971, the food habits of people began to change fast. By the 1980s, western food culture started influencing the urban consumers. This gave foreign companies an opportunity to establish their industries here, and among them, the beverage sector became one of the most dynamic.

Beverages are deeply rooted in Bengali culture. Traditional drinks such as lassi, and lemonade have been consumed for centuries. Lemonade is still the symbolization of hospitality today. Then, carbonated soft drinks entered the Bangladeshi market in the late 1980s. With the rise of media advertising in the 1990s, carbonated beverages gained instant popularity. In the early 2000s, many renowned foreign brands had established themselves in Bangladesh. Drinks such as Coca‑Cola, Pepsi, Fanta, Mirinda, 7UP, and Sprite became famous names. Coca‑Cola (1962) (via Abdul Monem Ltd.) and PepsiCo (1976) (via Transcom Beverage Ltd.) continued to dominate the market for decades. In 1981, PRAN entered the beverage market as the first local brand with fruit juice. Following that, Partex Beverage and Akij Food and Beverage Ltd (AFBL) entered consecutively in 1997 and 2006 with RC Cola and Mojo Cola.

Local brands such as PRAN and AFBL had to face a lot of challenges in the beginning of their journey, such as

- Weak infrastructure: Modern factories and distribution networks were expensive, making it difficult for local brands to reach consumers across the whole nation.

- Limited technology: As local brands did not have access to advanced bottling and packaging methods, their drinks struggled to compete against foreign products.

- Consumer bias: Bangladeshi brands were perceived as “cheap substitutes,” while multinational colas were associated with quality and safety.

- High taxes: The National Board of Revenue (NBR) imposed extra duties and minimum taxes on beverages, which made them costly and discouraged investment.

- Lack of capital: Since local firms had fewer financial resources compared to multinationals, their ability to advertise or expand quickly was limited.

Overcoming early struggles and pioneers

Despite these hurdles, local brands gradually shifted the narrative. PRAN focused on agro‑processing to build its juice portfolio by using rural farming supply chains. Partex introduced RC Cola and MUM Drinking Water, turning bottled water into a mass‑market product. Akij created a sensation with Mojo, showing that prioritising quality and cultural authenticity is a competitive advantage.

Policy reforms played a critical role as well. Stricter food safety laws and compliance requirements forced companies to modernise, raising the quality standards across the industry. Advertising regulations helped debunk misleading claims, especially in the case of energy drinks, earning consumer trust. While these initiatives were costly, they helped local brands leave behind the “low‑quality” label and reposition themselves as competitors on equal standing with the multinationals.

A few of the key figures who played an important role in the growth of the beverage industry are Abdul Monem Ltd, Amjad Khan Chowdhury and Sheikh Akij Uddin.

Abdul Monem Ltd. (AML): Abdul Monem became Coca‑Cola’s sole authorized bottler of Bangladesh in 1982. AML introduced modern bottling technology and distribution networks that set early standards in the industry. Its success pushed local companies to modernize in order to challenge global dominance.

Amjad Khan Chowdhury (PRAN‑RFL Group): Amjad Khan Chowdhury founded PRAN in 1981. His agro‑processing route turned local fruits into packaged juices linked rural farming with industrial growth that eventually made PRAN a household name.

Sheikh Akij Uddin (Akij Group): Sheikh Akij Uddin is the founder of AFBL. AFBL showed that adhering to the Bangladeshi taste and culture like their product Mojo, can lead a local brand to directly compete with multinationals.

Case Study: Akij’s rise in the beverage industry

Throughout the years, the dedication and persistence of local companies is the reason behind the growth of the Food and Beverage sector. Companies maintained stricter quality control, used modern technology, innovative packaging, socially responsible campaigns, culturally relevant promotions and adhered to local taste, all of which resulted in a solid industry employing millions. AFBL, a defining force in the industry, is one of the market leaders and a very good example of the good practices that has strengthened the foundation of the sector.

Entering the market in 2006, AFBL faced the challenges other locals had been facing for decades already and were unable to overcome such as weak infrastructure, limited technology, consumer bias, high taxation and more. However, Akij managed to turn these obstacles into opportunities with responsible practices as explained below.

Sensational cultural advertising

AFBL’s flagship product “Mojo” inspired by the Bangla word “Moja” (fun), is a bold cola drink that adheres to local taste. Mojo’s branding reflected local taste as well. Campaigns like “Asmane Pakha Melo” and “Antor is On” captured the consumers by mixing cultural authenticity and visuals with catchy jingles that still resonate with people till this day and bring them back to the nostalgic times.

Soon after Mojo’s success, AFBL introduced Frutika, a premium fruit juice brand that set new standards in quality and freshness. At a time when local juice was often seen as low‑quality, Frutika campaigns highlighted purity and lifestyle with “Ektu Beshie Pure”.

These campaigns made them unforgettable to consumers and helped become household names.

Strategic risks and campaigns

Strategic risks and campaigns

During late 2023 when Coca-Cola and Pepsi were facing global boycotts over the Israel-Palestine conflict, AFBL launched a Mojo Palestine Support campaign that is ongoing to this day. Bottles featured the Palestinian flag and Taka1 from every bottle sold to be donated to relief efforts via agencies in Qatar and Turkey.

The sales spiked by 30% and Akij donated Tk1.5 crore to Palestinian families. Their website wesupportpalestine.net tracks donations in real time for transparency and impact. This campaign, rather than a marketing stunt, was a strategic calculated risk that was rooted in principles rather than profits. In 2019, a “Road Safety Awareness Campaign” was conducted by Speed, aligning its energetic youthful image with conscious messaging and community engagement.

Despite potential commercial and diplomatic serious consequences, ethical leadership and integrity benefitted Akij and shaped a positive brand image.

Despite potential commercial and diplomatic serious consequences, ethical leadership and integrity benefitted Akij and shaped a positive brand image.

Quality and innovation

AFBL follows its founder’s motto. “Quality first.” Rather than mass production, they focus on producing premium quality products. They import European machinery to ensure calculated, high-quality output along with regular maintenance. The chairman famously stated that the company would never sell a product he would not consume himself.

As a research-based company, their research teams conduct blind tests, and feedback loops before launching new products. Their branding team is young and trend aware to connect with consumers.

While most juice brands in Bangladesh use hot fill, sterilization that degrades the flavour, aroma, and kills nutrients of the beverage, AFBL uses aseptic filling, an advanced and expensive technique where juice and packaging are sterilized separately, then filled in a sterile environment at room temperature. This preserves the natural taste, colour, and nutrients of ingredients without relying on preservatives. Frutika contains 33% real mango pulp which is far more than the industry average of 6–7% further reinforcing their quality first ethos.

Worker welfare

For their factory workers in both Dhamrai and Habiganj of AFBL, salaries and working hours are all in complete compliance with labour laws, such as double the usual rate for overtime. A worker in charge of distribution in one factory mentioned that those in urgent need of money can get half of their wage on the 15th of the month and the rest on the 30th of the month. Aside from that, the company provides facilities to workers for their well-being, improved work environment and productivity. Those facilities include access to transport, meals per shift, daycare, accommodation, in house medical support and hygiene support for female staff like menstrual sanitization.

For their factory workers in both Dhamrai and Habiganj of AFBL, salaries and working hours are all in complete compliance with labour laws, such as double the usual rate for overtime. A worker in charge of distribution in one factory mentioned that those in urgent need of money can get half of their wage on the 15th of the month and the rest on the 30th of the month. Aside from that, the company provides facilities to workers for their well-being, improved work environment and productivity. Those facilities include access to transport, meals per shift, daycare, accommodation, in house medical support and hygiene support for female staff like menstrual sanitization.

Office employees benefit from structured leave policies that include privilege, earned, and block leaves, maternity leaves, while the factory workers receive casual and festival leave in line with labour law. The company hosts family days for workers to enjoy picnics with their families. They also arrange recreational activities and religious gatherings like Waz Mahfil, Cricket and Badminton Tournaments along with celebrations of Eid and Pahela Baisakh with events, bonuses and activities.

AFBL employees also get the exposure to upskilling programmes and awareness sessions. They provide in-house training and workshops and emphasize safety measures for workers. External training on soft skills, food technology, labour law and more are conducted for the development of office employee capabilities. There are trust funds that support both employees even outsiders in need of financial assistance and many people have benefitted from it. These employee friendly facilities and policies have helped the company achieve a high degree of employee retention and satisfaction as AFBL’s employee turnover remains impressively low: 3–4% for workers, 1–2% for staff.

AFBL employees also get the exposure to upskilling programmes and awareness sessions. They provide in-house training and workshops and emphasize safety measures for workers. External training on soft skills, food technology, labour law and more are conducted for the development of office employee capabilities. There are trust funds that support both employees even outsiders in need of financial assistance and many people have benefitted from it. These employee friendly facilities and policies have helped the company achieve a high degree of employee retention and satisfaction as AFBL’s employee turnover remains impressively low: 3–4% for workers, 1–2% for staff.

Together, these practices show how Akij transformed the very challenges that once held back local brands into stepping stones of its success.

Current struggles of the beverage sector and possible future

Despite its rapid expansion, the beverage industry in Bangladesh is navigating a new set of challenges at present. Sustainability is one of them. With the growing pressure to reduce plastic waste, improve recycling, and adopt energy‑efficient production methods, sustainability has become a pressing issue. At the same time, consumers are more knowledgeable and aware than ever. The rising health awareness is switching consumer demand to healthier alternatives. Sugary carbonated drinks are losing to juice, low‑calorie alternatives, and functional beverages.

International markets require strict compliance with global safety and quality standards, which demands heavy investment in technology and certification, making export difficult. Finally, consumer expectations are transforming. Younger generations are looking for products that combine innovation with ethical branding and social responsibility. Also, as more Bangladeshis move abroad for education and work, the demand for familiar food and beverage abroad increases resulting in the need of increased exports all around the world.

Looking ahead, the industry’s future will depend on how effectively companies adapt to these shifts. Companies that will expand to healthier product lines, strengthen sustainability practices, and build stronger export networks will survive in the next phase of growth.

AFBL’s Adaptation of Industry Challenges and Future Plans

AFBL’s Adaptation of Industry Challenges and Future Plans

Akij adapts to current industry struggles by

- Sustainability: In the age of performative commitment to sustainability, AFBL follows a structural and impactful route. Every factory has its own recycling plant with the goal of zero waste. They have a Starlinger PET recycling line which processes used plastic bottles into new packaging. They have received Green Factory Award 2025 for energy efficiency and waste management becoming a leading company in sustainable practices.

The company holds all necessary licenses and certifications up to date, along with 5S and GMP (Good Manufacturing Practices). They are also in full compliance with national and international standards.

- Health awareness: Consumers are becoming increasingly cautious about sugary drinks. Frutika’s aseptic filling and higher fruit pulp content adhere to consumer demand.

- Global competition: Export markets require strict compliance with international standards. Currently, AFBL is exporting to 47 countries which contributes to our economy directly. Mojo has markets in Asia, Africa, and the Middle East.

In the future, AFBL will concenrate on health‑focused innovations to meet shifting consumer tastes and continue to thrive to become a zero waste company. For global expansion, they will build stronger export networks and continue to adhere to local taste and branding for cultural authenticity. Lastly, they will continue to be a socially responsible company that practices ethical branding.

Conclusion

Akij Food and Beverage Ltd is a real-life example and business model which proves that sustainable practices benefit businesses in the long term and give them longevity. Their structural integrity resulted in both commercial success and public trust. From prioritising local taste, research and cultural relevance to the bold Palestine campaign, daycare facilities and green practices, they show that strategic risks and operational excellence can coexist with sustainability and not only co-exist but thrive.

They are the highest tax payers in the industry and among the top three in our nation. By ensuring quality, prioritising consumer demand, doing safe environmental practices and taking care of their workers, AFBL has achieved immense success over the years and today, are leading the beverage industry with 40% market share of Mojo, leaving behind multinational giants.

The story of AFBL shows that sustainable practices, respecting worker dignity, and ethical branding are not just ideals, they are competitive advantages. In a market where multinationals once ruled, they have shown that a local brand can thrive and even lead the way.

As one executive put it:

“The best thing about Akij? দেশের টাকা দেশেই থাকে.” Our money stays in our country.

However, it also reflects a larger pattern in Bangladesh’s industrial growth. Sectors like garments, pharmaceuticals and ceramics have transformed similarly. By looking closely at Akij, we see more than the success of one company but rather the broader trajectory of Bangladeshi industries going from survival against multinationals to setting its own benchmarks for quality, sustainability, and global competitiveness.