As Canada is the second largest country in the world in landmass, people would probably think that land prices would be low here and so would be the house prices. But the reality is different. House prices in Canada’s major cities are far beyond the affordability of ordinary people. Some pertinent questions are: why are house prices in the large cities of Canada, especially in the Greater Toronto Area (GTA), so high? Where do so many buyers come from? What factors play a major role in the GTA’s hot housing market?

As Canada is the second largest country in the world in landmass, people would probably think that land prices would be low here and so would be the house prices. But the reality is different. House prices in Canada’s major cities are far beyond the affordability of ordinary people. Some pertinent questions are: why are house prices in the large cities of Canada, especially in the Greater Toronto Area (GTA), so high? Where do so many buyers come from? What factors play a major role in the GTA’s hot housing market?

Push and pull factors

There are several factors. The chief among them is the influx of corrupt overseas money. Illicit financial assets of corrupt persons are historically hidden in Swiss banks and other ‘safe havens’, like Panama and Cayman Island. Added to that is investment in real estate in countries, deemed safe and secure. The corrupt people mainly from developing countries are buying houses in safe overseas countries for both investment and families’ dwelling. Such practices are encouraged by policies of the countries where the ill-gotten money is transferred.

Thus, there are both ‘push’ and ‘pull’ factors. While the motivation to secure the corrupt money by transferring it acts as a push factor, incentives offered (or the lack of effective prevention measures) by the receiving countries act as a pull factor.

Corruption and illicit transfer of funds

Around the developing world many corrupt personalities – politicians, officials, and even those thought to be honest such as judges and academics – accumulated millions of dollars through unfair means in recent decades, especially since the deregulation and privatization agenda became dominant. These corrupt people do not feel secure in their home countries – both for their money and families. So, they choose to invest their corruptly accumulated money in rich countries.

According to a 2010 estimate, each year developing countries lose US$20-40 billion due to corruption. Developing countries lost approximately US$7.8 trillion in illicit financial flows from 2004 to 2013. The World Economic Forum’s recent estimate shows that corruption, bribery, theft and tax evasion, and other illicit financial flows cost developing countries US$1.26 trillion per year.

Canada ‘snow-washes’ corrupt money

Canada is a popular destination for corrupt money as found by a recent Deloitte report. The New York Times has reported that Canadian officials are aware of it, but have taken insufficient measures to combat. Canada is such an appealing money-laundering destination that there is a coined term to refer to illegal money laundered here: ‘snow-washing’.

An estimate shows that up to CN$113 billion per year is ‘snow-washed’ in Canada. A significant amount of this ‘snow-washed’ illicit money is invested in real estate. A report by Criminal Intelligence Service Canada (CISC), a national intelligence agency, confirmed that Canadian real estate is a haven for money laundering and fraud.

The CISC report also concluded that organized crime is engaged in everything from laundering, to helping regular families forge mortgage documents. All of this creates extra demand for housing, helping to push home prices higher — and rents as well.

Canada encourages illicit fund transfers

Writing in the Financial Post, Diane Francis, observed, “Canadian housing prices are unaffordable, at least in part, because successive governments have failed to address the fact that Canada is one of the world’s foremost tax and secrecy havens”.

For example, the land title system and rules around lawyers’ trust accounts in British Columbia helped foreigners buy some CN$16 billion worth of property in recent years, often remaining anonymous. Cash from ‘high-risk’ buyers — foreign companies and trusts — makes up for 20 to 60 per cent of purchases.

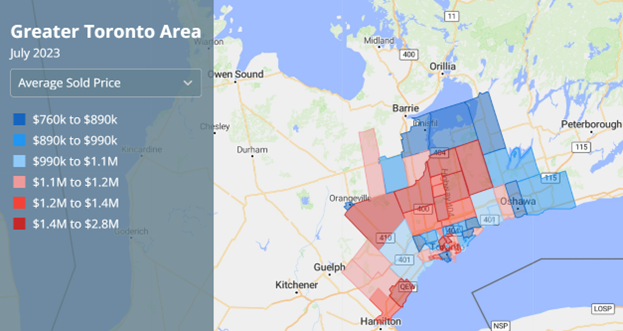

Until January 2023, non-Canadians were also allowed to purchase many homes in major Canadian cities. Data show that non-Canadians own about 4 per cent of homes in the Greater Toronto Area. In Vancouver, it is about 8 per cent.

Only after voter backlash, the government imposed a two-year ban on non-Canadians buying residential property starting in January 2023. However, many are sceptical about how effective the policy is. Many believe that foreigners are still buying Canadian residential homes using various legal loopholes.

Leaving aside corrupt money, the Canadian government encourages capital flights from developing countries. For example, one can get a ‘Start-up Visa’ if he or she brings or secures a minimum investment of CN$200,000 and has ‘enough money’ (depending on number of family members) to settle and live in Canada before he or she makes money from his or her business.

Begum para – The Bangladesh connection

How Mississauga, Toronto, and some other areas in GTA, have turned into ‘Begum Para’ is well known. These are GTA suburbs where the families of corrupt Bangladeshi billionaires live while they continue to syphon off their ill-gotten money from Bangladesh. Now “Begum para” became a symbolic term without referring to any particular physical location. Wherever corrupt Bangladeshi billionaires invest their ill-gotten money is counted as “Begum para”. An astonishing 84 per cent of households in Bangladesh who had interacted with different public and private service institutions have been victims of corruption, according to the World Economic Forum.

The amount of money smuggled out of Bangladesh through false information on imports and exports is estimated at US$8-9 billion a year. Adding the money of politically influential and corrupt individuals, the total would amount to US$12-15 billion, according to the Transparency International. Global Financial Integrity, a financial corruption watchdog, has reported that an estimated US$90 billion were laundered out of Bangladesh during 2011-2018.

Begum para (Mississauga) Housing Prices

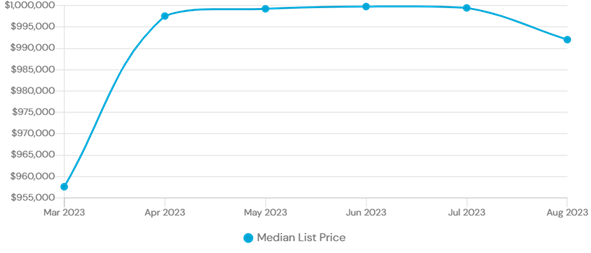

The median house prices in Begum para continued to shoot up until April 2023 despite monetary policy tightening and rising mortgage rate to combat inflation and the introduction of non-resident tax. This is a clear indication that house prices are influenced by money coming from outside the system. The corrupt billionaires are unaffected by Canadian interest rates and their desperation to shift money and family to safety outweighs the disincentive of newly introduced non-resident Canadian tax.

The median house prices plateaued since May 2023 and have been falling since July 2023. This is perhaps due to the prospect of the Canadian government’s sanctions on Bangladeshi officials following the USA and UK. Canadian authorities have already identified over 200 Bangladesh nationals who had laundered huge amounts of money and mostly invested in real estate.

A global phenomenon

Canada is not alone to experience sky-rocketing house prices. It is a global phenomenon as the corrupt billionaires seek ‘safe havens’ for their ill-gotten money and families. A recent research paper published in Kyklos (16 May 2022) provides an estimate of the impact of money laundering on residential house market prices in Italy. Money laundering is also “locking many Australians out of owning their own homes”, heard a Senate inquiry. The UK parliamentary inquiry found that illicit funds help sustain Britain’s inflated property market through the purchase of homes that are frequently left unoccupied, emptying the wealthier parts of London of residents.