Financial independence of working women is a crucial element in societal progress, fostering empowerment and equality. When women control their financial resources, they gain autonomy in decision-making, enabling them to pursue aspirations and contribute meaningfully to communities. Beyond personal fulfilment, economic self-sufficiency reduces dependence, enhances resilience, and breaks down gender-based barriers. It promotes a more inclusive workforce and challenges traditional norms, fostering a society where women’s economic achievements are celebrated and respected. Encouraging financial literacy and dismantling systemic obstacles further pave the way for women to navigate the economic landscape confidently and independently.

In recent years, Bangladesh has witnessed significant strides in advancing the financial independence of women. Successive governments of Bangladesh have implemented a comprehensive set of policies to promote the financial independence of women. However, significant deficits in working women’s empowerment still exist.

Government policies and programmes

Notable examples of government policies and programmes include the National Microcredit Policy of 2006, focusing on expanding microcredit services with provisions for interest rate reduction and institutional capacity strengthening. The Small and Medium Enterprise (SME) Policy of 2006 is intended to support the growth of women-owned SMEs through access to finance, technology, and training. Microcredit programmes and skills training aims to contribute increasing employment and income generation for women, effectively reducing poverty across the country. Financial empowerment of women allows them greater autonomy and participation in society. Microcredit programmes provide access to small loans without collateral, fostering income generation and financial independence.

The role of Microcredit Programs in poverty alleviation in Bangladesh has been undoubtedly crucial since the inception of such programs immediately after the independence of the country and throughout its different phases of development till now with the collaboration of the Government of Bangladesh, NGOs and development partners. Yet the microfinance as an effective tool for women’s empowerment is highly debatable. The impact of microfinance in empowering women at various dimensions commencing from household to beyond household level and the broader arena is not equal. Access to financial resources is not enough to bring high-level empowerment of women rather it should be combined with training, financial literacy, legal support, and education to attain the desired goal.

The role of Microcredit Programs in poverty alleviation in Bangladesh has been undoubtedly crucial since the inception of such programs immediately after the independence of the country and throughout its different phases of development till now with the collaboration of the Government of Bangladesh, NGOs and development partners. Yet the microfinance as an effective tool for women’s empowerment is highly debatable. The impact of microfinance in empowering women at various dimensions commencing from household to beyond household level and the broader arena is not equal. Access to financial resources is not enough to bring high-level empowerment of women rather it should be combined with training, financial literacy, legal support, and education to attain the desired goal.

Skills training strives for enhancing employability and earnings, while access to finance enables savings and business investments, ensuring financial security. Entrepreneurship support seeks to facilitate business growth, job creation, and financial autonomy. Thus, the National Policy for Gender Equity and Social Inclusion of 2011 emphasizes gender equity and inclusion in development, including economic empowerment through increased access to education, employment, and financial services for women. In recent years, Bangladesh has evidenced an upliftment in the rate of female entrepreneurs in the country’s business who are contributing positively towards the economic prosperity of the country.

The Government of Bangladesh has recognized Small and Medium Enterprises (SMEs) as one of the thrust sectors with remarkable participation of women in SMEs along with significant contribution to the country’s GDP. Despite such appreciable stride, there are presence of various pull factors hindering the gender-inclusive economic growth of the country namely access to credit, inadequate market information, lack of skill and bureaucratic complexity. Apart from gender-related factors, family work-life balance and cultural patterns scowl in the advancement of women compared to their male counterparts.

Initiatives like the Women’s Empowerment and Livelihoods Programme (WELP), Gender Responsive Budgeting (GRB) Initiative, Women’s Entrepreneurship Development Programme (WEDP), Access to Finance for Women (AFW) Programme, Women’s Property Rights (WPR) Programme, and Family Planning and Reproductive Health (FPRH) Programme are aimed to provide targeted support, including financial assistance, training, and property rights. Gender-Responsive Budgeting (GRB) has been introduced to allocate resources considering women’s needs, and improving access to education, employment, and financial services

However, the ground reality of Gender Responsive Budgeting at the grassroots level is totally different from the desired outcome when GRB is considered as a tool of gender equalizer. Political influence, lack of positive will of government officials and political representatives, absence of monitoring mechanisms and culture of dependency of women on the male members in the society are creating barriers in the implementation of GRB mechanism.

Regulatory bodies like the Microcredit Regulatory and Oversight Authority (MRA) are put in place to ensure compliance with microcredit policies, while the National Women’s Commission (NWC) is intended to promote women’s rights and empowerment. Social protection schemes for women have been adopted to address the risk and vulnerability of women following a life cycle approach under the umbrella framework through the formation of the National Social Security Strategy in 2015.

Reserved seats for female representatives aim at greater political participation of women which may contribute to increasing empowerment of women and participation of women in decision-making at community and national level. Awareness campaigns have been undertaken to educate women about rights and opportunities, encouraging steps to improve their financial situation These policies collectively demonstrate the government’s commitment to empowering women and enabling them to reach their full potential.

Significant gaps persist

Although some remarkable progress in attaining financial independence for women has been made with time, there is still a long way to go to reach the desired goal. Despite commendable efforts to promote financial independence for Bangladeshi women, substantial gaps have been encountered. Surveys conducted by Bangladesh Bureau of Statistics (BBS) have revealed that the percentage of women in the labour force has increased from 20% in 2017-16 to 25.34% in the 4th quarter report of 2023. Regardless of such increasing participation of women, there is a significant gender gap in the financial inclusion of women as reported by Aspire to Innovate (a2i), in 2023; evidently, only 36% of women are bank account holders compared to 65% of men.

According to the World Bank, in 2018, 59.4% women participated in household decision making, while over 50% of Bangladeshi women became victims to intimate violence, which is higher than world average of around 27%. Among the rural households, 13% of women have landownership, as opposed to 70% of men. Traditional gender roles and societal expectations continue to hinder women’s access to education and employment opportunities, limiting their economic participation.

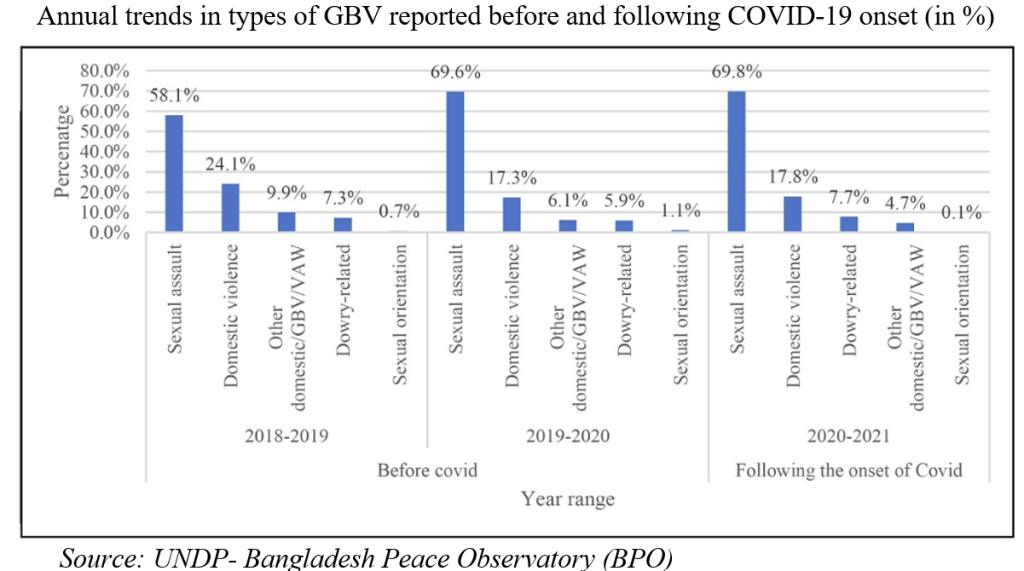

Data collected by the Bangladesh Peace Observatory (BPO) – an initiative of UNDP’s ‘Partnerships for a Tolerant and Inclusive Bangladesh’ (PTIB) project – shed insights into gender-based violence (GBV) in Bangladesh. The online database contains verified open-source data on violence since 2014, based on selected Bangla and English print and online media reports. The analysis of the date base reveals that GBV trends have been rising since 2018 and worsened with the pandemic.

Concluding remark

Discriminatory practices in workplaces, such as unequal pay and restricted career advancement, pose formidable barriers to achieving financial autonomy. Cultural norms may discourage women from managing finances independently or pursuing entrepreneurial ventures. Limited access to financial services and resources exacerbates these challenges, making it difficult for women to establish and sustain financial independence. Additionally, ongoing efforts are crucial to address systemic obstacles and ensure sustained financial inclusion for women across Bangladesh, necessitating a multifaceted approach involving education reform, workplace equality initiatives, and increased financial support. Furthermore, the collaboration of actors from various levels including international, national and local levels is mandated to facilitate gender equality and empowerment of women.