Bangladesh has celebrated the 52nd Victory Day anniversary on 16 December 2023 as a least developed country (LDC) going through its graduation process to a developing country according to the criteria of the United Nations Economic and Social Council (UN-ECOSOC). It is quite remarkable that it has emerged as a fast-growing economy in 52 years of its independent existence from a so-called ‘International Basket Case’ status declared by an American bureaucrat named Johnson in 1972.

The then national security advisor to the US president Nixon, Dr Henry Kissinger, agreed to that derogatory adjective. Dr Kissinger died at the age of 100 years in this very month of December 2023. I am happy that Dr Kissinger could realize before his death how Bangladesh proved him terribly wrong about his prediction. The first world-famous book on Bangladesh published in 1975, authored by Faaland and Parkinson, was titled Bangladesh: A Test Case of Development. The title was justified by the two authors with the words, ‘If the problem of Bangladesh can be solved, there can be reasonable confidence that the less difficult problems of development can also be solved. It is in this sense that Bangladesh is to be regarded as the test case’ (Faaland & Parkinson, 1975, p.5).

In these 52 years, Bangladesh’s journey in the path of development was challenging as well as frustrating. But, the nation could overcome the negative roadblocks successfully with its major achievements, which observers could hardly predict at the start of its difficult struggle as an independent country. In the present article, I like to focus on these major achievements. In some future writings, I hope to delve on the issues of major frustrations. The following dimensions of Bangladesh’s success story seem quite remarkable:

-

- Rapid poverty reduction: In 1972, about 82% of Bangladesh’s population were categorized as belonging to the ‘below poverty line’ category of people. The Household Income and Expenditure Survey (HIES) 2022, conducted by the Bangladesh Bureau of Statistics (BBS), the official statistical organization of the Government of Bangladesh, claims that the percentage of people below the poverty line (measured by the cost of basic needs method) has come down to only 18.7% in Bangladesh by the year 2022 – 20.5% in rural areas, and 14.7% in urban areas.

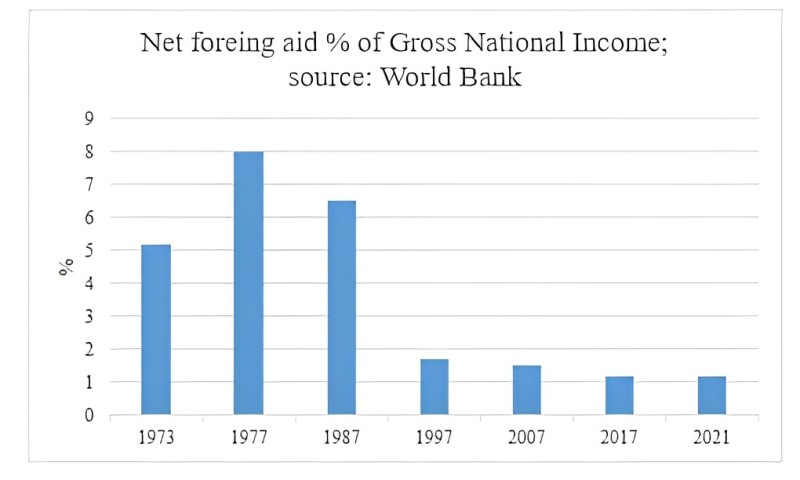

Headcount Rate HIES 2022 - Self-reliance: Foreign aid disbursed as a proportion of Bangladesh’s GDP, which had been consistently above 10% in the late 1970s and had risen to 13.7% in the financial year 1981-82, has come down in three decades to below 1% in the financial year 2013-2014. More significant is the fact that less than 1% of such foreign loans and grants in 2022-23 are food aid and about 99% are various types of project loans, implying that the economy’s viability does not in any way depend on foreign aid, and that a large proportion of the project loans can be done away with if the policy makers seriously decide to get out of ‘aid dependence’. In the decade of the1970s, food aid as percentage of total disbursed aid was 29.4% on average. Commodity aid as a percentage of disbursed aid in that decade was 40.8% and that of project aid was 29.8%. In those times, the annual development budgets of the Bangladesh governments were overwhelmingly dependent on foreign loans and grants. Now that food aid has dwindled in importance and commodity aid has become non-existent, the myth of foreign aid as the lifeblood of the economy of Bangladesh and a life and death question for the people of Bangladesh is shattered in the years running up to 2023.

- Current account surplus: Bangladesh has been consistently achieving surplus in the current account of its balance of payments during 11 of the last 15 financial years. The spectacular growth rates of remittances sent by Bangladeshi overseas migrants and non-resident Bangladeshis (NRBs) living abroad and the spectacular and uninterrupted growth of Bangladesh’s export earnings in all these years are the main factors behind this comfortable situation in the balance of payments. Export earnings have been growing steadily, and it has reached US$55.56 billion in 2022-23 whereas export earning in 1981-82 was a paltry US$752 million. The foreign exchange reserve of Bangladesh had been steadily increasing every year since 2001 up to 2021, crossing US$ 48 billion by the end of August 2021. However, it has been decreasing ever since, and it has dipped to US$19.4 billion in December 2023 because of factors like increasing capital flight through over-invoicing of imports, under-invoicing of exports, non-repatriation of export-earnings and the ‘hundi’ method of sending remittances by Bangladeshi migrants.

- Food self-sufficiency:

- Rapid poverty reduction: In 1972, about 82% of Bangladesh’s population were categorized as belonging to the ‘below poverty line’ category of people. The Household Income and Expenditure Survey (HIES) 2022, conducted by the Bangladesh Bureau of Statistics (BBS), the official statistical organization of the Government of Bangladesh, claims that the percentage of people below the poverty line (measured by the cost of basic needs method) has come down to only 18.7% in Bangladesh by the year 2022 – 20.5% in rural areas, and 14.7% in urban areas.

Bangladesh has achieved self-sufficiency in rice production in spite of its very high population density, very meagre land-man ratio and a process of shrinkage of cultivable land due to population pressure on scarce land. Bangladesh produced 39.2 million tons of rice in 2022, whereas it could produce only 11 million tons of rice in 1972. Bangladesh has become the second largest producer of sweet-water fish in the world. It has achieved self-sufficiency in the production of vegetables, beef, mutton, egg and poultry meat. A virtual agrarian revolution is in progress in agriculture. It is also significant that Bangladesh’s food grain production has largely come out of the uncertainties of monsoon rains and floods, because, the Boro rice, which has been contributing nearly 60% of Bangladesh’s rice production of recent years, is produced in the dry season largely through irrigation and modern inputs, and, therefore, is less susceptible to vagaries of nature like floods, droughts, untimely monsoon rains, excessive monsoon rains, etc. compared to the Aman and Aus varieties of rice, the traditional two main types of rice formerly. It is also significant that a sizable buffer stock of about 2 million metric tons of food grains has been built up by June 2023 to guard against any unforeseen world or national crisis, shortages, natural disasters or volatility of food prices either in the local or in the international market of food grains.

Bangladesh has achieved self-sufficiency in rice production in spite of its very high population density, very meagre land-man ratio and a process of shrinkage of cultivable land due to population pressure on scarce land. Bangladesh produced 39.2 million tons of rice in 2022, whereas it could produce only 11 million tons of rice in 1972. Bangladesh has become the second largest producer of sweet-water fish in the world. It has achieved self-sufficiency in the production of vegetables, beef, mutton, egg and poultry meat. A virtual agrarian revolution is in progress in agriculture. It is also significant that Bangladesh’s food grain production has largely come out of the uncertainties of monsoon rains and floods, because, the Boro rice, which has been contributing nearly 60% of Bangladesh’s rice production of recent years, is produced in the dry season largely through irrigation and modern inputs, and, therefore, is less susceptible to vagaries of nature like floods, droughts, untimely monsoon rains, excessive monsoon rains, etc. compared to the Aman and Aus varieties of rice, the traditional two main types of rice formerly. It is also significant that a sizable buffer stock of about 2 million metric tons of food grains has been built up by June 2023 to guard against any unforeseen world or national crisis, shortages, natural disasters or volatility of food prices either in the local or in the international market of food grains.

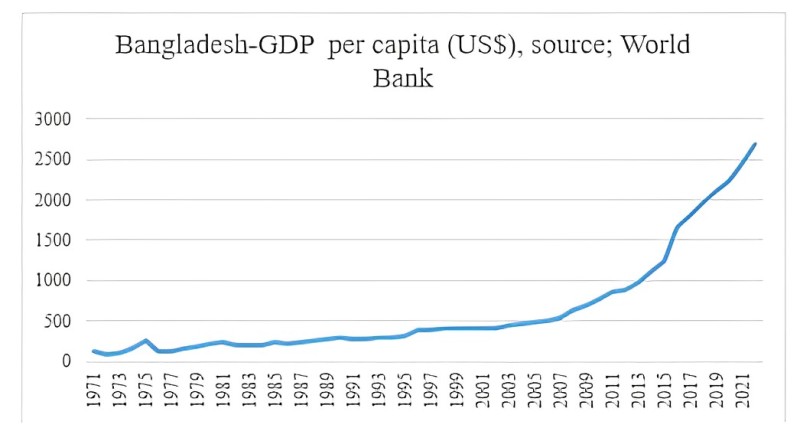

5. Spectacular economic growth: The growth rates of GDP in Bangladesh have been consistently increasing during the last three decades and reached 8.13% in the financial year 2019-20. However, the growth rate dipped below 4% in 2020-21 because of the corona virus pandemic. The Russian-Ukraine War further affected the growth rate in 2021-22, but Bangladesh has regained the growth trajectory in 2022-23. The GDP growth rate reached 6% in 2022-23. The World Bank has declared in 2015 that Bangladesh had graduated to the category of lower-middle income countries from its earlier status of a low-income country.

6. Economic diversification:

Bangladesh’s export earnings mainly come from export of manufactured items. Knitwear and woven readymade garments (RMG) constitute 84% of the export earnings of Bangladesh. Bangladesh has become the second largest exporter of garments in the world after China. Bangladesh’s traditional export items like jute and jute goods are showing signs of revival in the international market. Export of leather goods is also picking up nicely. A few new items like pharmaceuticals, ceramics, shipbuilding, agro-based food products and ICT services are showing good promises in the export market. All these signs indicate that Bangladesh’s spurt in export earnings is not a fluke.

Bangladesh’s export earnings mainly come from export of manufactured items. Knitwear and woven readymade garments (RMG) constitute 84% of the export earnings of Bangladesh. Bangladesh has become the second largest exporter of garments in the world after China. Bangladesh’s traditional export items like jute and jute goods are showing signs of revival in the international market. Export of leather goods is also picking up nicely. A few new items like pharmaceuticals, ceramics, shipbuilding, agro-based food products and ICT services are showing good promises in the export market. All these signs indicate that Bangladesh’s spurt in export earnings is not a fluke.

7. Growth of remittance: According to government statistics, there are about 15.5 million overseas migrants and non-resident Bangladeshis (NRBs) living and working abroad. The countries of the Middle East are the major destinations of overseas migrants from Bangladesh, but the United Kingdom, the USA, Malaysia and Singapore are also significantly large destinations of overseas migrants and NRBs. Though the overwhelming majority of migrants and NRBs from Bangladesh are less skilled workers, the yearly flow of remittances from overseas migrants and NRBs has been consistently increasing during the last four decades, and the remittances through formal channels have reached US$21.61 billion in 2022-23. Various research studies show that the flow of remittances through different informal channels like ‘hundi’ and the flow of undeclared foreign currencies brought in by home-coming migrants may be equally large or larger in case of Bangladesh. Though foreign exchange earnings diverted to ‘the parallel economy’ through these informal channels of remittances largely finance smuggling, capital flight, money laundering, overseas education of sons and daughters of affluent Bangladeshis, overseas medical treatment of the middle-income and affluent Bangladeshis, frequent foreign tours of a fast increasing group of rich Bangladeshi families having either business links or having links with the political and bureaucratic quarters, and illegal remittances of foreigners working in Bangladesh and foreign companies operating in Bangladesh, these approximately 15.5 million overseas migrants and NRBs, both legal and illegal, have however been acting as a formidable source of foreign currencies for the Bangladesh economy. The remittance flow has helped to counterbalance the deficit in the balance of trade of Bangladesh, and has been instrumental in achieving surpluses in the current account in recent years. This phenomenon has made Bangladesh’s foreign trade regime quite comfortable for the policy makers. Remittances, both through formal and informal channels, have been acting as a very important substitute of foreign direct investment in Bangladesh. Knowledgeable quarters believe that the yearly flow of remittances may be as large as US$45-US$50 billion, which have been contributing substantially in accelerating the country’s economic development.

8. Microcredit movement: The success of the microcredit movement pioneered by Profssor Yunus’s Grameen Bank has provided Bangladesh an effective tool for reaching formal credit to the poorer village people, more than 95% of them landless women, at reasonable rates of interest. This has made the lives and livelihoods of microcredit recipients somewhat easier. Researches show that about 28% of the target population of microcredit delivery organizations are experiencing some improvements in their livelihood, though a much smaller proportion of borrowers are believed to be successfully graduating from their status as ‘population below poverty line’. We firmly believe that microcredit alone cannot be legitimately considered as an effective tool for overcoming the poverty creation and recreation processes of the social, economic and political ‘system’ of Bangladesh, but this successful innovation for delivering formal credit to the poorer segments of the population, though at somewhat higher interest rates, should be lauded for introducing a very positive change on balance in the economy of Bangladesh.

9. Employment expansion: The flourishing knitwear and woven garments industries have been providing employment to about 4 million people, of which 70% are women, by the financial year 2022-23. Though the wage levels of most of these workers are meagre, and there are allegations of super-exploitation by multinational firms reaping the lion’s share of the super profits generated through the garments factories of Bangladesh, such formal industrial jobs for the uneducated and the most marginalized female workers have been acting as a significant deterrent factor against destitution and crushing poverty of the women, who are now somewhat relieved from the specters of degrading existence and sub-human professions of the past (like those as domestic servants, commercial sex workers, etc.) and saved from dangers of possible human trafficking abroad. In this respect, the garments sector has emerged as a very positive institution for the livelihood improvements, economic uplift and empowerment of the poor and marginalized women in Bangladesh.

10. Women’s empowerment: Another of Bangladesh’s success stories revolves around the issue of women’s empowerment and gradual reduction of gender discrimination. Bangladesh has already achieved gender equality in primary school enrolment. The successes achieved in rapidly increasing women’s self-employment through the microcredit delivery system introduced by the Grameen Bank and several thousand NGOs and industrial employment of about three million female workers in the ready-made garments and knitwear factories have virtually transformed into a social revolution, which has widespread ramifications for gender equity, fertility reduction and slowing down of population growth. The fact that Bangladesh’s population growth rate has come down to about 1.12% in the year 2022 from a high rate of about 2.4% in 1974 is definitely good news for the most densely populated LDC of the world, Bangladesh. It did not escape the attention of Nobel Laureate Amartya Sen, who has praised the success story in his book The Argumentative Indian published in 2005 with the following words:

“It is also clear that the result of women’s participation is not merely to generate income for women, but also to provide many other social benefits that come from women’s enhanced status, enterprise and independence. The remarkable success in Bangladesh of organizations like the Grameen Bank and BRAC, directed particularly at the economic and social roles of women, illustrate how women’s agency can help to transform the lives of all human beings. Indeed, in the gradual transformation of Bangladesh, which was seen not long ago as a ‘basket case’, into a country with significant economic and social success and much promise, the agency role of women is playing a critically important part. The precipitate fall of the total fertility rate in Bangladesh from 6.1 to 2.9 in the course of two decades (perhaps the fastest decline in the world) is merely one illustration of the dynamic power of women’s agency and the consequential correlates of gender equity” (Sen, 2005, p. 249).

11. Digital transformation: Last but not the least, Bangladesh has been fast catching up in digitalizing its economy through prioritizing the adoption of the information and communication technology during the last fourteen years. The number of mobile phone users has crossed 180 million in Bangladesh, and the number of internet users has crossed 90 million by 2023. The rate of tariff on average for mobile phone use is the lowest in Bangladesh compared to the other South Asian countries, and the whole country has come under the coverage of mobile phones. Export of ICT services has also been increasing at commendable rates during the last few years.

As indicated in the beginning paragraph, there are many negative elements in the political and economic scenario of the country like increasing corruption, breakdown of the democratic process, extortive political culture and statecraft, capital flight, dangerously increasing income inequality, crony capitalism, concentration of income among the super-rich and bad governance. I hope to analyse those issues of frustration in some future writing.

Muinul Islam

Muinul Islam, a recipient of Ekushe Padak, is a retired professor of Economics, University of Chittagong. After his retirement he was nominated by the University Grants Commission (UGC) of Bangladesh as a UGC Professor (July 2016-June 2018). Muinul Islam was awarded a gold medal by the Bangladesh Economic Association in 2012 as one of the four topmost economists of Bangladesh. He has published nine books in economics nationally and internationally. He also authored eight research monographs and published thirty-seven scientific papers in reputed international and national journals. He was Director General of the Bangladesh Institute of Bank Management and President of the Bangladesh Economic Association. Muinul Islam obtained his PhD from Vanderbilt University in 1981. He also has Master degrees in Economics from Dhaka University and McMaster University. Muinul Islam writes regularly on contemporary economic and social issues of Bangladesh in leading national dailies. E-mail: dr.muinul@yahoo.com

[…] case to a middle-income country”, by Anis Chowdhury (Global Bangladesh, Vol. 1, Issue 1) and “Bangladesh’s fifty-second Victory Day anniversary: Major achievements”, by Muinul Islam (Global Bangladesh, Vol. 1, […]