Context and backdrop

A country’s external debts obligations include debts incurred by the government, including public sector corporations, and private sector debt the servicing of which is contractually guaranteed by a public entity resident in the same economy as the debtor – together referred to as public and publicly guaranteed debt (PPG) – and interests on them.

In recent years, issues of external debt servicing and debt carrying capacity have emerged as a global concern in policy circles. A number of reports by international organisations and multilateral financial institutions, such as UNCTAD’s A World of Debt 2023, the World Bank’s International Debt Report 2023 and the IMF’s Are We Heading For Another Debt Crisis in Low Income Countries? bears this out.

The key message emanating from these reports is that many low-income countries (LICs) could face debt distress and fall into the dreaded middle income trap for various reasons, including post-covid recovery challenges, adverse implications of the Russia-Ukraine war on the domestic economy and the balance of payments, and the way external sovereign debt was being managed by some of these countries.

In the backdrop of the above, and in view of emergent trends, there is a need for being strategic in managing Bangladesh’s external borrowings, sovereign debt servicing and the country’s debt carrying capacity.

Bangladesh’s external debt

Bangladesh’s outstanding external public and publicly guaranteed (PPG) debt, at USD 79.0 billion, as of December, 2023, is not high when compared to economies of similar size. The amount, equivalent to about 17.0% of the country’s GDP, is not an outlier when compared to corresponding figures for other developing countries and lower middle-income countries (LMICs).

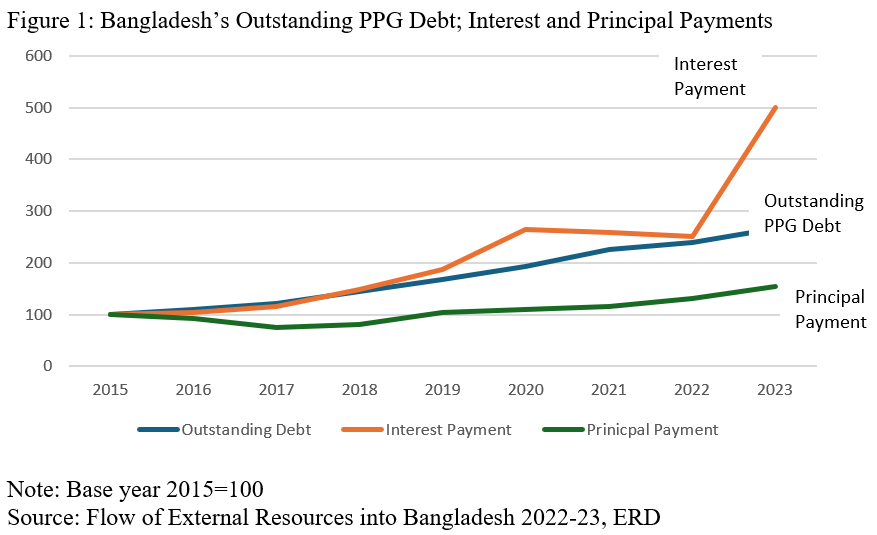

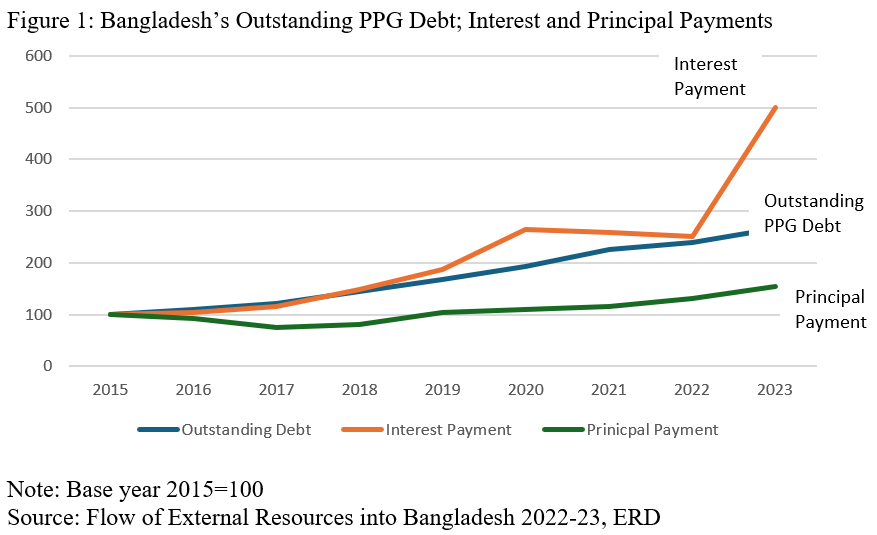

However, if the recent trends of growth of the country’s external debt servicing obligations are taken into consideration, management of external sovereign debt should demand a closer attention of Bangladesh’s policymakers. Figure 1 shows the rising trend of Bangladesh’s outstanding external PPG. In particular, there has been a sharp rise in interest payments between FY 2015 and FY 2023 (5 times).

Bangladesh’s PPG debt increased from USD 21.5 billion in FY2010 and USD 26.6 billion in FY 2015 to USD 44.5 billion in FY 2019 to 70.8 billion in FY 2023. This would mean that outstanding PPG debt has risen by 3.3 times in a decade. Over the corresponding period, interest payments increased from USD 0.48 billion to USD 1.31 billion, by about 168.0%, while payments of the principal amount posted a rise of about 48.0%. The country’s debt servicing payments in the first nine months of the current FY 2023-24 have gone up by 49% compared to the corresponding period of the preceding year, with interest payments rising by 117.0% and principal payments posting a growth of 22%.

The prepared annual development plan (ADP) for FY 2025 shows that while domestic borrowings are set to come down by 2.4%, the foreign borrowings are expected to go up by 6.4% when compared to FY 2024. The pressure as regards external sovereign debt servicing is set to rise further over the near-term future in the backdrop of the current low levels of foreign exchange (forex) reserves, slowdown in the growth of earnings from exports of goods and services, higher costs of borrowings, and the grace period of some of the significantly large foreign loans for infrastructure projects coming to an end.

Factors driving debt distress

Concerns for Bangladesh’s growing external debt obligations arise from two main related factors – loss of concessional loans and changing composition of loans from official to commercial sources, and from multilateral to bilateral sources. Both are due to Bangladesh’s graduation from a low-income country (LIC) to a lower middle-income country (LMIC) in 2015, according to the World Bank (WB) classification.

Middle-income graduation

While middle-income graduation is a recognition of Bangladesh’s impressive economic achievements, it implies that Bangladesh is no longer eligible for the highly concessional IDA-type loans of the WB.

The WB’s International Development Association (IDA) was designed to provide interest-free loans – called credits – and grants to governments of the poorest countries. It also provides highly concessional loans – at about 0.7% annual interest, with a grace period of up to 10 years, and a maturity period of up to 40 years – to low-income countries. The WB’s International Bank for Reconstruction and Development (IBRD lends to governments of middle-income and creditworthy low-income countries.

As Bangladesh has made the transition from IDA-eligible country to a Gap Country to the present status as a Blend Country, with terms of borrowings becoming increasingly stringent. The country is expected to graduate to the World Bank’s relatively high-cost IBRD country category over the next few years.

As a matter of fact, costs of borrowing from both multilateral and bilateral sources have already started to rise significantly in the backdrop of Bangladesh’s middle-income graduation. This is a major reason for Bangladesh’s rising debt repayment obligations of recent times. It should also be noted that as Bangladesh graduates from LMIC to Upper Middle-Income Country (UMIC) status, all borrowings will be of non-concessional type (except in exceptional cases).

Changing external dent portfolio

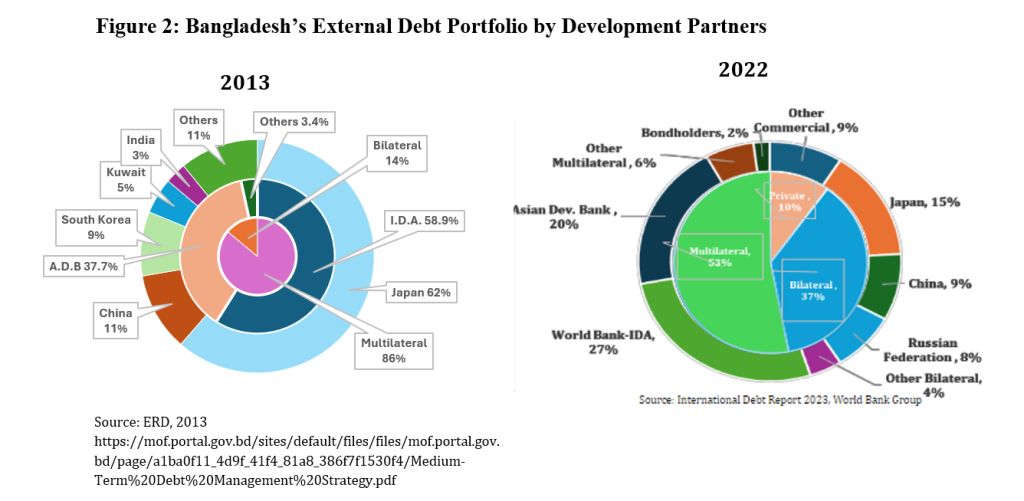

Since Bangladesh’s middle-income graduation, Bangladesh’s external debt portfolio and terms of loans have experienced a number of notable changes –from concessional to non-concessional, from predominantly multilateral towards notable shift towards bilateral loans, and from loans with easier terms to a growing share of borrowings incurred on more stringent terms.

For example, between 2013 and 2022, the share of highly concessional IDA loans in total external borrowing portfolio of Bangladesh came down from 58.9% to 27%, while the share of more costly loans from bilateral sources, such as China and Russia went up significantly (Figure 2). Also note that share of concessional bilateral sources such as Japan posted a sharp decline in total bilateral loans.

Figure 2: Bangladesh’s External Debt Portfolio by Development Partners

Sri Lanka faced a similar situation following its graduation to a lower middle-income country (LMIC) in 1997. Before becoming a LMIC, most of its foreign debt came in the form of concessionary funding from multilateral organizations such as the World Bank, Asian Development Bank, and Japan International Cooperation Agency. It got favourable loan conditions as a low-income country. However, as access to concessionary loans declined upon its classification as a LMIC, the country moved to a new structure of foreign debt composition, with an increasing proportion of commercial loans, mostly from international capital markets.

The commercial and bilateral borrowings with higher interest rates and shorter maturity periods accelerated since Sri Lanka’s graduation to an upper middle-income country in 2019. The situation turned worse when some of these borrowings were for politically motivated “bad” projects.

Analysing the problem

As is known, during the grace period only interests on borrowings have to be paid, while during the maturity period payments need to be made for both interests and the principal amounts. It is to be noted that grace periods of some of the big loans have already come to an end, or are expected to end over the next few years. Indeed, this is the case for several large infrastructure projects commissioned in the recent past years.

These include Rooppur Nuclear Project, commissioned in 2016, financed by Russia to the tune of USD 11.3 billion, with a grace period of 10 years and a maturity period of up to 20 years; and the Rail link on the Padma Bridge Project, commissioned in 2018, financed by China to the tune of USD 2.67 billion, with a grace period of 5 years and a maturity period of 15 years.

The annual interest rate in case of these two projects are LIBOR+1.75%, and 2% (with a service charge of 0.25%), respectively. LIBOR (London Interbank Offered Rate) was a benchmark interest rate at which major global banks lent to one another in the international interbank market for short-term loans. LIBOR has been replaced by the Secured Overnight Financing Rate (SOFR) on 30 June, 2023.

The LIBOR/SOFR rates have almost doubled since the time when some of the loans were negotiated (these rates were about 2%-3% at the time), having fallen sharply (to about 0.3%-0.4%) during the Covid period, and rising thereafter to (5%-6%) in more recent times (Figure 3). Consequently, servicing of loans incurred on flexible LIBOR/SOFR terms have become more costly.

Debt servicing obligations have also become more onerous for external-funded projects that generate income in local currency. This is the case for majority of infrastructure projects (e.g., projects in transport and power sectors). This is because of the significant depreciation of the Taka over the past couple of years, of about 30%. This was not foreseen when many of these loans were negotiated.

Moreover, time and cost escalation, a rather very common phenomenon in view of project implementation in the Bangladesh context, has meant that project cost ends up being considerably higher than what was initially planned. This results in internal, economic and financial rates of returns of the projects being below the original estimates presented in the respective feasibility studies. This undermines viability of projects and could create problems for future debt servicing.

Thus, a number of factors including increasingly large amounts of external borrowings, higher interest rates, more stringent terms of borrowings, upward revision of project costs and others have combined to trigger a sharp rise in Bangladesh’s debt repayment obligations.

LDC graduation implications

Bangladesh’s graduation from the least developed country (LDC) status will take place in November 2026. It is true that the LDC graduation does not have direct implications for access to, and the terms of, external borrowings. Country status for purposes of external borrowings is exclusively based on the World Bank’s classification of counties according to their per capita gross national income (GNI). However, there will be some consequences which should be taken into cognisance in estimating the country’s debt carrying capacity.

First, the country will lose preferential market access for goods given to the LDCs, such as duty-free, quota-free (DFQF) market access or preferential tariffs, as well as preferential rules of origin, for products imported from LDCs. This will have major implications on export earnings and forex reserves.

Second, the end of access to WTO’s aid for trade window and technical and capacity building supports, as well as access to low- cost funds such as the LDC Climate Fund, will need to be kept in mind in this connection. These will have important implications for external borrowings since Bangladesh will be required to underwrite the related expenditures from its own or borrowed funds.

It may be recalled that Bangladesh is currently considered a Medium Debt Carrying Capacity Country according to the WB-IMF debt sustainability framework. These developments ought to be kept in the perspective as Bangladesh gets on with the task of external debt management in near- and medium-term future.

Recommended Measures

All efforts should be geared to maintain the current status and to avert the likelihood of falling into the category of a Weak State, or into a debt crisis like Sri Lanka. Bangladesh’s future sovereign debt management strategy should be informed and guided by the following considerations:

(a) Bangladesh should explore opportunities of additional borrowings from new sources of funds and diversify its loan portfolio (e.g., from AIIB, and NDB, of which Bangladesh is a member, and from which Bangladesh has already taken loans for a number of projects). In this respect, interest rates and terms of loans should be carefully examined. Particularly loans with flexible interest rates must be weighed with due care to assess their future implications in terms of liabilities and debt servicing obligations. Whether to go for fixed or flexible interest rates will need to be carefully weighed.

(b) Both terms of borrowings and quality of investment will need to be carefully examined. Lender selection process must be rigorous – what type of project calls for which type of loans, at what terms and from which development partners – must be decided in an informed manner. Project selection ought to be made based on economic rationale and feasibility studies carried out by competent agencies, and not on other considerations. Expected returns must be estimated based on reliable data and rigorous studies. Every effort should be made to ensure that projects are completed on time, accountability is enforced and there is good governance at every stage of project implementation.

(c) Negotiation of loans that are of non-concessional type must be pursued with caution and care. To note, the Economic Relations Division (ERD) of the Planning Commission has developed a formula to assess the terms of loans; loans exceeding 25% threshold is considered to be non-concessional. Non-concessional loans must be appropriately justified when negotiated.

(d) Bangladesh will need to proactively pursue opportunities of getting support from target-oriented funds set up globally such as the Loss and Damage Fund announced at CoP 28. Borrowings for purposes of mitigating environmental damage must be carefully managed by taking advantage of this type of funds and other funds such as IMF’s Resilience and Sustainability Facility which tend to be of soft term nature.

(e) Loans with components that include learning tours, unnecessary procurement, cash disbursement etc. need to be carefully monitored, and, whenever possible, discarded.

(f) Bangladesh Bank should spell out how it will operationalize its crawling peg modality for of currency depreciation. Delays will incentivize keeping earnings abroad in anticipation of further depreciation of the BDT, with consequent adverse implications for forex reserves.

(g)Loans incurred by various government entities that are underwritten by sovereign guarantee needs to be carefully monitored.

(h) Whilst budget support type of loans allows flexibility in undertaking expenditure, the government must be careful about how these are spent. Transparency and accountability in the use of such funds ought to be ensured.

(i) Loans with conditionalities such as single source procurement should be properly scrutinized to assess their implications for the economy, whether raw materials and intermediate goods are available locally, at lower prices, and ensure good value for money.

(j) Human resources, expertise and analytical capacities to deal with external debt management issues and assess the country’s debt carrying capacity will need to be further strengthened in view of the anticipated challenges facing Bangladesh, now and in the future.

(k) It is good that the Ministry of Finance, Bangladesh Bank and the ERD prepare periodic reports on Bangladesh’s debt status and debt service-related data, including those concerning external borrowings. Usability of these reports by policymakers may be further improved by raising the quality of data generated by various relevant agencies, standardization of reporting and by undertaking evidence-based rigorous analyses and projections as regards future stream of sovereign debt obligations and medium-term debt carrying capacity of Bangladesh.

Mustafizur Rahman

Professor Mustafizur Rahman is Distinguished Fellow at the Centre for Policy Dialogue (CPD), a leading think tank in Bangladesh and South Asia. Earlier he had taught at the University of Dhaka. Dr. Rahman was post-Doctoral Fellow at Oxford University, UK and Senior Fulbright Fellow at Yale University, USA. He has published widely in Bangladesh and abroad. He was a member of the Panel Economists for Sixth and Seventh Five Year Plans and Perspective Plan of Bangladesh. Dr. Rahman is Series Editor of South Asia Economic Policy Studies published by Springer.

[…] concerned observers believe that the situation can quickly turn into a debt crisis. Thus, urgent actions are needed, including identifying odious debts and refusing the illegitimate […]

[…] concerned observers believe that the situation can quickly turn into a debt crisis. Thus, urgent actions are needed, including identifying odious debts and refusing the illegitimate […]

[…] involved observers imagine that the situation can quickly turn into a debt crisis. Thus, pressing actions are wanted, together with figuring out odious money owed and refusing the […]

[…] concerned observers believe that the situation could quickly turn into a debt crisisUrgent measures are therefore needed, including identifying odious debts and refusing the unlawful […]

[…] concerned observers believe that the situation can quickly turn into a debt crisis. Thus, urgent actions are needed, including identifying odious debts and refusing the illegitimate […]

[…] concerned observers believe that the situation can quickly turn into a debt crisis. Thus, urgent actions are needed, including identifying odious debts and refusing the illegitimate […]