The leather industry in Bangladesh stands as a testament to the nation’s economic evolution, transforming from a mere exporter of raw hides to a significant global player in value-added leather goods and footwear. While often overshadowed by the colossal ready-made garments (RMG) sector, leather is consistently the country’s second-largest foreign exchange earner, a designated ‘thrust sector’, and a crucial component in the drive for export diversification. Its history since the nation’s independence in 1971 is a narrative of initial state-led growth, ambitious private sector expansion, and a persistent, ongoing struggle with environmental and compliance challenges.

The historical foundation and post-independence phases (1971 – early 2000s)

The roots of the organized leather sector predate 1971, with the first tanneries established in the 1940s, primarily near Narayanganj, before shifting to the Hazaribagh area of Dhaka. After gaining independence in 1971, the newly formed Government of Bangladesh nationalized the existing tanneries (approximately 30 units), marking the initial phase of the industry’s life in the new nation. This state-controlled period lasted roughly until the early 1980s, during which the focus was mainly on producing semi-processed leather, known as “wet blue” leather, for export. The raw material advantage derived from the large domestic livestock population, particularly the massive annual supply during the Eid-ul-Adha festival, provided a strong foundation.

The second major phase, beginning in the late 1980s and accelerating in the 1990s, was characterized by the privatization of nationalized units and a shift towards higher value addition. Driven by an expanding private sector, the industry began to move beyond raw hides to produce finished leather, and critically, to manufacture leather footwear and goods. The industry gained significant momentum as local entrepreneurs and foreign investors recognized the potential of Bangladesh’s cheap labour and indigenous raw materials. This period saw the sector progress from exporting over 90% raw hides to becoming a prominent exporter of finished leather products, laying the groundwork for its current export standing.

The 2000s ushered in a period of aggressive growth, with export earnings crossing the $1 billion mark in the early 2010s. The sector started being recognized as the “next RMG”, particularly the footwear segment, which emerged as the fastest-growing sub-sector. International buyers began shifting their sourcing strategies, looking for alternatives to countries like China and Vietnam, a trend from which Bangladesh benefited significantly, especially in the US market.

The evolution of the Bangladeshi leather industry since 1971 is most vividly demonstrated by the rise of the footwear and leather goods sub-sector. Historically, the industry acted primarily as a supplier of raw materials (raw hides) and later, semi-processed products (wet blue and crust leather), meaning most of the value-added manufacturing took place abroad. The shift toward finished footwear and leather goods represents the culmination of the nation’s push for industrial diversification and higher revenue per unit.

The evolution of the Bangladeshi leather industry since 1971 is most vividly demonstrated by the rise of the footwear and leather goods sub-sector. Historically, the industry acted primarily as a supplier of raw materials (raw hides) and later, semi-processed products (wet blue and crust leather), meaning most of the value-added manufacturing took place abroad. The shift toward finished footwear and leather goods represents the culmination of the nation’s push for industrial diversification and higher revenue per unit.

Footwear companies in Bangladesh’s leather industry

Footwear is now the fastest-growing segment and the largest single contributor to the leather sector’s total export earnings, consistently making up over 60% of the industry’s total merchandise export value. This growth is driven by several key factors.

Leading footwear manufacturers, such as Apex Footwear, Bata Shoe Company (Bangladesh), Leatherex, and Landmark Footwear, recognized that the highest profits lay in converting finished leather into end-user products. This movement created a robust forward linkage, transforming the leather industry’s export composition from low-value raw material to high-value finished products.

The footwear sector leverages Bangladesh’s core advantages: domestic availability of raw materials (hides) and competitive labour costs. This combination has attracted significant foreign direct investment (FDI), particularly from China, Taiwan, and Korea, which have established large, modern export-oriented factories within Export Processing Zones (EPZs).

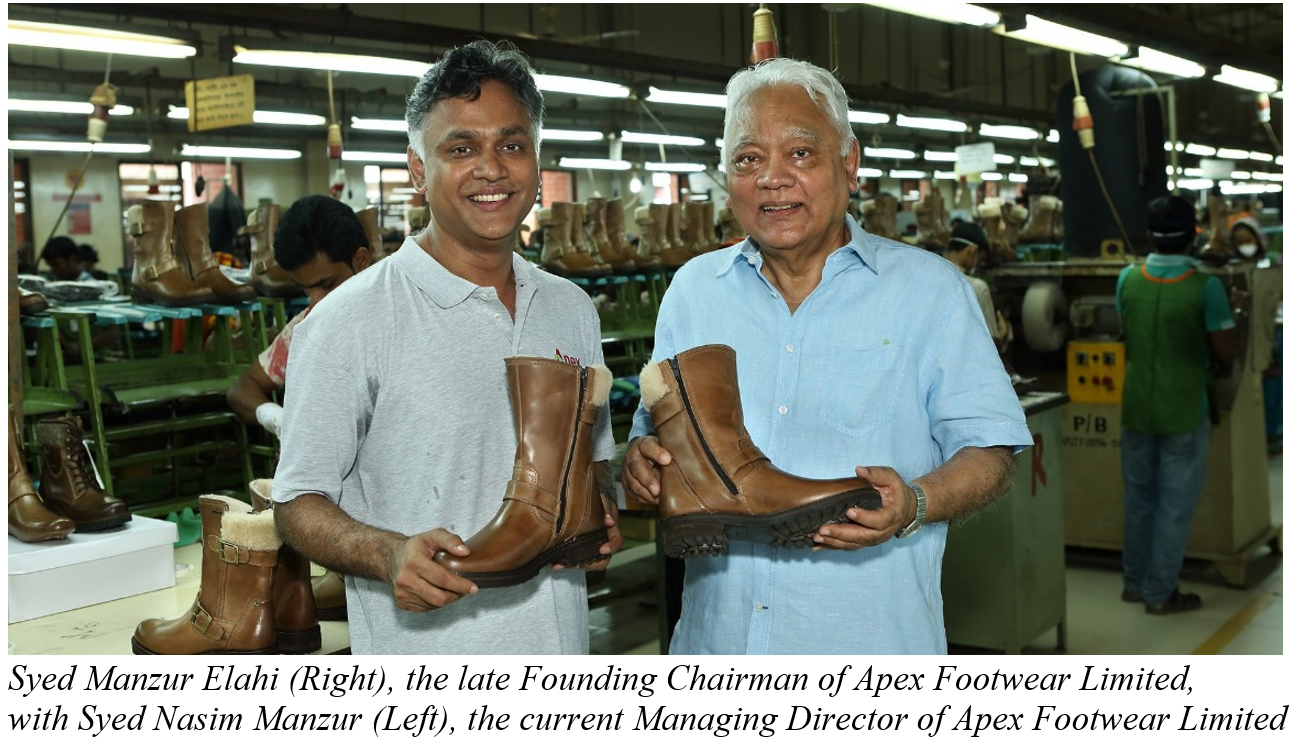

Late Syed Manzur Elahi, the founder of the Apex Group has extensively contributed to the industry’s journey from exporting low-value raw hides to high-value finished goods. Syed Manzur Elahi’s career effectively charts the biggest arc of Bangladesh’s leather industry since independence.

He first ventured into the leather business shortly after 1971, starting as an agent for a French leather importer. Seizing the opportunity during the government’s privatization drive in 1976, he acquired a state-owned unit, Orient Tannery, which he later renamed Apex Tannery Ltd. This move placed him at the core of the traditional tannery sector in Hazaribagh, focusing on producing finished leather and wet blue for export.

Recognizing the limitations and low margins of exporting raw and semi-processed leather, Syed Elahi made the strategic leap to the highest-value segment: finished footwear manufacturing. This was a bold move, requiring substantial investment in advanced, Italian-inspired technology and establishing modern factories outside the congested, low-compliance Hazaribagh area (in Gazipur).

Apex Footwear Limited: The vanguard of value addition in Bangladesh’s leather industry

Apex Footwear Limited is recognized as one of Bangladesh’s leading and most progressive footwear manufacturers, exemplifying the evolution of the country’s leather and footwear industry over the past fifty years. Headquartered in Dhaka and operating a cutting-edge manufacturing plant in Chandra, Gazipur, Apex employs over 3,100 staff and manufactures a diverse array of footwear for both domestic and international markets. Its accomplishments exemplify the wider modernization of Bangladesh’s manufacturing sector.

Apex Footwear Limited is recognized as one of Bangladesh’s leading and most progressive footwear manufacturers, exemplifying the evolution of the country’s leather and footwear industry over the past fifty years. Headquartered in Dhaka and operating a cutting-edge manufacturing plant in Chandra, Gazipur, Apex employs over 3,100 staff and manufactures a diverse array of footwear for both domestic and international markets. Its accomplishments exemplify the wider modernization of Bangladesh’s manufacturing sector.

The growth of Bangladesh’s footwear industry offers the essential context for comprehending Apex’s rise. Following independence in 1971, the industry continued to be predominantly characterized by small-scale tanneries and artisanal operations owing to constrained technological capabilities. The entry of multinational corporations in the 1980s, coupled with increasing global demand for leather products, laid the groundwork for large-scale industrial manufacturing. By the 1990s and 2000s, domestic companies initiated the mechanization of their operations, invested in quality assurance, and adopted international compliance standards. The relocation of tanneries to Savar, the establishment of LFMEAB, and the sector’s growing export focus provided a conducive environment for Apex’s expansion and leadership.

Apex distinguishes itself through a blend of operational excellence, sustainable manufacturing practices, sophisticated quality assurance, and robust governance. The company applies the KAIZEN methodology on its manufacturing floors, streamlining workflows, minimizing waste, and maintaining consistent productivity.

Its SATRA-accredited laboratory, an uncommon feature among Bangladeshi manufacturers, facilitates in-house testing of materials and finished products in accordance with international standards. As a result, Apex sustains a production efficiency rate of 67. 6% and an on-time delivery rate of 99.2%, benchmarks that exceed those of domestic competitors and position the company favourably among international purchasers prioritizing reliability and compliance.

Its SATRA-accredited laboratory, an uncommon feature among Bangladeshi manufacturers, facilitates in-house testing of materials and finished products in accordance with international standards. As a result, Apex sustains a production efficiency rate of 67. 6% and an on-time delivery rate of 99.2%, benchmarks that exceed those of domestic competitors and position the company favourably among international purchasers prioritizing reliability and compliance.

Another distinguishing characteristic of Apex compared to the rest of the industry is its balanced procurement approach, with approximately 50 percent of its inputs sourced locally. This not only enhances backward linkages within Bangladesh’s leather sector but also decreases lead times and alleviates supply chain risks. Competitors significantly dependent on imported materials are more susceptible to fluctuations in global prices and logistical disruptions, whereas Apex’s integrated approach fosters enhanced resilience and cost efficiency. Its product portfolio comprises leather formalwear, casual footwear, synthetics, and semi-athletic footwear, which enables the company to diversify its customer base, catering to both domestic consumers and retailers throughout Europe, North America, and Asia.

Apex is widely acknowledged for its people-oriented culture and its commitment to social responsibility, which distinguishes it from the majority of local manufacturers. Its leadership prioritizes transparent communication, mutual trust, and the empowerment of employees. The organization implements comprehensive training and leadership development initiatives aimed at identifying and nurturing future managers from within its personnel. Through initiatives such as the Skills for Employment Investment Program (SEIP) and the Centre of Excellence for Leather Skills Bangladesh Limited (COEL), Apex offers disadvantaged youth (including many from rural regions) comprehensive technical training in shoemaking, quality assurance, and supervisory functions. These initiatives contribute to the expansion of Bangladesh’s competent workforce while fostering loyalty and enhancing long-term human capital for the organization.

Beyond workforce development, Apex adopts a structured corporate social responsibility strategy centred on empowerment, community well-being, and environmental stewardship. The company participates in health initiatives, educational sponsorship programmes, and disaster relief efforts, particularly during emergencies such as the COVID-19 pandemic, when it continued providing income support to employees. Few companies within the industry possess CSR portfolios of similar scope and institutionalization, establishing Apex’s prominent reputation for ethical and socially responsible practices.

Beyond workforce development, Apex adopts a structured corporate social responsibility strategy centred on empowerment, community well-being, and environmental stewardship. The company participates in health initiatives, educational sponsorship programmes, and disaster relief efforts, particularly during emergencies such as the COVID-19 pandemic, when it continued providing income support to employees. Few companies within the industry possess CSR portfolios of similar scope and institutionalization, establishing Apex’s prominent reputation for ethical and socially responsible practices.

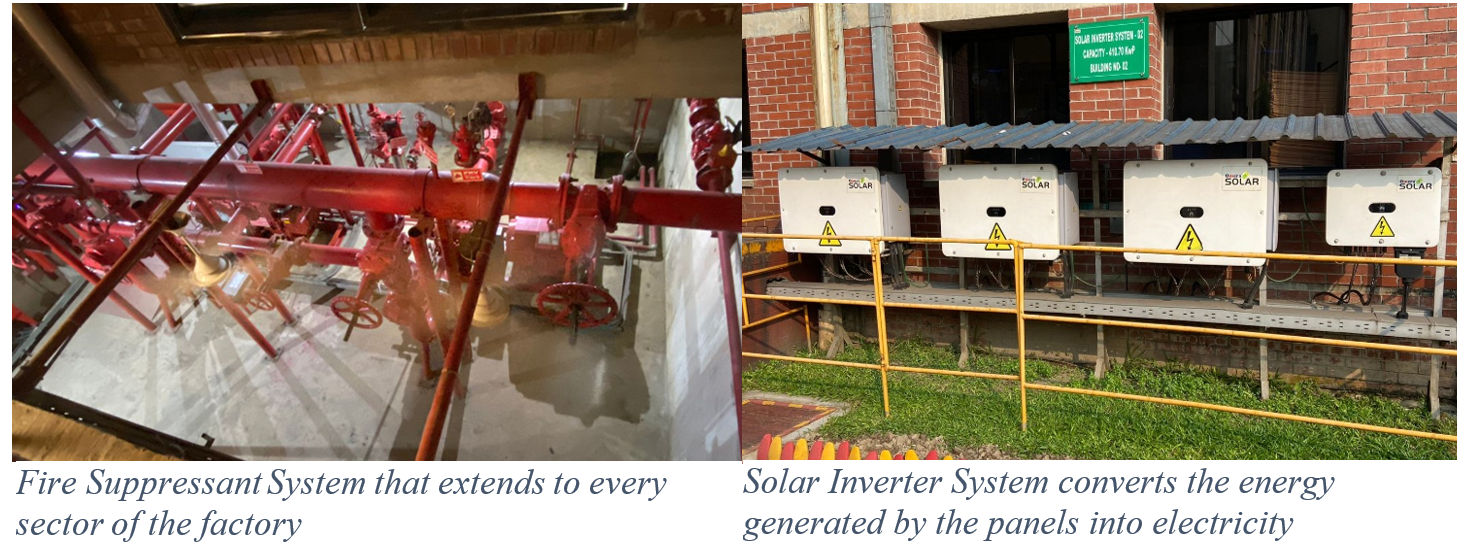

Where Apex most notably surpasses its competitors is in sustainability and environmental innovation. Its manufacturing facilities are LEED-certified and outfitted with sophisticated environmental management systems. Apex has made substantial investments in renewable energy and energy independence: three gas generators provide 70% of the factory’s requirements, supplemented by 2.89 MWh of solar capacity, increasing its renewable energy share to 30%. This infrastructure not only decreases carbon emissions, offsetting approximately 5,000 MWh but also guarantees operational continuity in a nation affected by frequent power instability.

Where Apex most notably surpasses its competitors is in sustainability and environmental innovation. Its manufacturing facilities are LEED-certified and outfitted with sophisticated environmental management systems. Apex has made substantial investments in renewable energy and energy independence: three gas generators provide 70% of the factory’s requirements, supplemented by 2.89 MWh of solar capacity, increasing its renewable energy share to 30%. This infrastructure not only decreases carbon emissions, offsetting approximately 5,000 MWh but also guarantees operational continuity in a nation affected by frequent power instability.

The company demonstrates excellence in water stewardship by implementing a rainwater catchment system that collects 4.3 million litres annually, satisfying 34% of its water needs. This considerably diminishes groundwater extraction and decreases the electricity consumption related to water treatment. Furthermore, the company has implemented a state-of-the-art fire suppression system valued at over Taka 4 crore in addition to noise reduction infrastructure costing Taka 70 lakh.

Apex’s waste management practices further solidify its position as an environmental leader. The company recycles approximately 61% of its 1,800 tons of non-hazardous waste annually, including the repurposing of leather remnants, the neutralization of chemical residues, and the recycling of paper and packaging materials. By harmonizing with European environmental standards, Apex improves both cost efficiency and credibility within sustainability-focused export markets, an advantage that many local competitors find difficult to replicate due to elevated compliance costs.

Together, these defining factors, including excellence in production, rigorous quality control, regional integration, human capital development, and innovative sustainability initiatives position Apex as a standard-bearer for Bangladesh’s industrial future. Its capacity to harmonize profitability with environmental stewardship and social welfare establishes it not only as a market leader but also as a paradigm of ethical and sustainable industrial development. Apex Footwear Limited thus signifies much more than a prosperous manufacturing enterprise; it embodies a symbol of Bangladesh’s resilience, innovation, and progressive advancement within global value chains. Through its forward-looking strategies and steadfast dedication to quality and sustainability, Apex establishes a benchmark that consistently elevates the entire footwear industry.

Conclusion

The journey of the Bangladesh’s leather sector since 1971 is a testament to national ambition, but it remains a story of two halves. On one side, pioneers like Apex Footwear, driven by Syed Manzur Elahi’s vision, showed the world the huge potential of this industry. They successfully jumped from merely selling raw hides to exporting high-value, quality finished shoes, establishing a global benchmark for manufacturing excellence and sustainability with their advanced facilities and ethical practices.

On the other side, the foundation of the tannery industry has struggled to keep up. The move from the polluting Hazaribagh to the new Savar Industrial Park solved a geographic crisis, but created a new compliance bottleneck. Today, the sector’s $1 billion export ceiling is directly tied to the performance of the Savar Central Effluent Treatment Plant (CETP). The future of the entire industry rests on closing this gap. By ensuring the tanneries can achieve the required international environmental certifications, Bangladesh can finally complete its value chain. This final act of compliance will unlock the full potential of companies like Apex, proving that the leather industry is ready to take its place as a reliable, sustainable, and powerful second pillar of the national economy.